Fed Rate Hike in 2025: Impact on US National Debt

Anúncios

The Federal Reserve’s anticipated 0.75% interest rate hike in early 2025 is projected to increase the cost of borrowing for the U.S. government, potentially exacerbating the national debt by raising debt servicing costs and influencing economic growth and inflation.

The implications of monetary policy decisions reverberate throughout the economy. Understanding what is the projected impact of the Federal Reserve’s anticipated 0.75% interest rate hike in early 2025 on national debt is crucial for investors, policymakers, and everyday citizens alike, as it affects everything from the cost of borrowing to the overall health of the economy.

Anúncios

Understanding the Federal Reserve’s Role

The Federal Reserve (often referred to as the Fed) plays a pivotal role in shaping the economic landscape of the United States. It is tasked with maintaining price stability, maximizing employment, and moderating long-term interest rates. To achieve these goals, the Fed employs various tools, with the federal funds rate being one of the most significant.

Federal Funds Rate

The federal funds rate is the target rate that the Federal Open Market Committee (FOMC) wants banks to charge one another for the overnight lending of reserves. This rate influences other interest rates throughout the economy, impacting borrowing costs for individuals, businesses, and even the government. Changes to this rate can have profound effects on economic activity and inflation.

Anúncios

The Mechanics of a Rate Hike

When the Fed raises the federal funds rate, it becomes more expensive for banks to borrow money. These increased costs are typically passed on to consumers and businesses in the form of higher interest rates on loans, mortgages, and credit cards. This, in turn, can slow down economic growth by making it more expensive to invest and spend.

Here are some key ways the Fed’s rate hikes affect the economy:

- Increased Borrowing Costs: Higher interest rates make it more expensive for individuals and businesses to borrow money, discouraging spending and investment.

- Slower Economic Growth: Reduced spending and investment can lead to slower economic growth, potentially impacting job creation and overall economic activity.

- Inflation Control: Higher interest rates can help curb inflation by reducing demand in the economy. This makes it more expensive to buy goods and services, cooling down the rate at which prices increase.

In summary, the Federal Reserve’s role in setting interest rates is critical. Rate hikes aimed at controlling inflation can have a significant ripple effect across the economy. Understanding these mechanisms helps in assessing the potential impact of such decisions on the national debt.

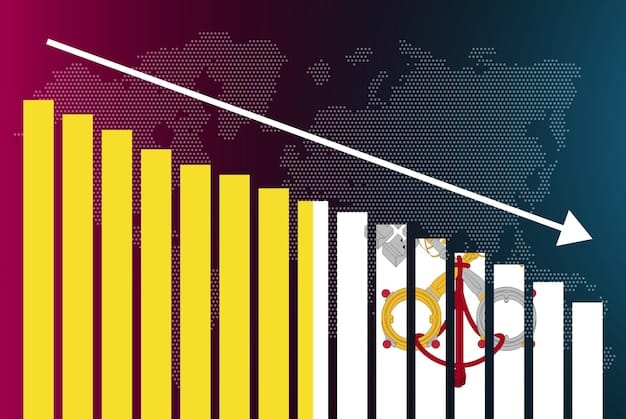

Projected Impact on National Debt Servicing Costs

One of the most direct impacts of a Federal Reserve interest rate hike is on the cost of servicing the national debt. The national debt represents the total amount of money the U.S. government owes to its creditors. A significant portion of this debt is in the form of Treasury securities, which are periodically refinanced.

Rising Interest Payments

When interest rates rise, the cost of issuing new debt also increases. As existing Treasury securities mature and need to be refinanced, the government must issue new securities at the prevailing, higher interest rates. This leads to higher interest payments on the national debt, increasing the overall debt servicing costs.

Compounding Effect

The compounding effect of higher interest rates on the national debt can be substantial. Each increase in the interest rate adds to the annual debt servicing costs, which can quickly accumulate over time, potentially diverting funds from other essential government programs and services. This can create budgetary constraints and force difficult decisions about government spending.

Consider these potential consequences:

- Increased Budget Deficits: Higher debt servicing costs can lead to larger budget deficits, requiring the government to borrow even more money.

- Reduced Investment: Increased debt payments may reduce the government’s ability to invest in infrastructure, education, and research and development.

- Economic Drag: Higher interest rates and increased debt burden can act as a drag on economic growth, further complicating fiscal management.

In conclusion, the projected impact of a Federal Reserve interest rate hike on national debt servicing costs is an important consideration. Rising interest payments can exacerbate the national debt problem, potentially leading to fiscal challenges and reduced investment in essential government programs.

Economic Growth Implications

The ripple effects of a Federal Reserve interest rate hike extend far beyond just the national debt. These changes in monetary policy can significantly affect overall economic growth. Adjustments to interest rates are a primary tool used by the Fed to manage inflation and maintain economic stability. However, these adjustments can also impact various sectors of the economy.

Slowing Down Economic Activity

Higher interest rates typically lead to reduced borrowing. This can discourage both consumer spending and business investment. When individuals and companies hesitate to borrow, economic activity slows down. Large-scale investments become more expensive, and consumer spending on big-ticket items decreases.

Impact on Employment

The slowdown in economic activity can also impact employment. Businesses may reduce hiring or even lay off workers in response to decreased demand. This rise in unemployment can further dampen consumer spending, creating a negative feedback loop. Policymakers need to tread carefully to balance inflation control with maintaining a healthy jobs market.

Here are some of the specific ways an interest rate hike may affect economic growth:

- Reduced Business Investment: Companies curtail expansion plans as borrowing costs increase, affecting long-term growth prospects.

- Decreased Consumer Spending: Higher loan and mortgage rates reduce disposable income, leading to decreased spending on non-essential items.

- Housing Market Impact: Increased mortgage rates cool down the housing market, leading to decreased construction activities and related spending.

In summary, while interest rate hikes can be essential for controlling inflation, they also carry potential risks for economic growth. Policymakers must carefully weigh these factors when making decisions about monetary policy. The goal is to strike a balance that keeps inflation in check without stifling economic activity.

Inflationary Pressures and the Rate Hike Response

One of the primary reasons the Federal Reserve raises interest rates is to combat inflationary pressures. Inflation, the rate at which the general level of prices for goods and services is rising, erodes the purchasing power of money and can destabilize the economy. Understanding how rate hikes are meant to counteract inflation is crucial.

The Mechanism of Inflation Control

By increasing the cost of borrowing, the Fed aims to reduce demand in the economy, making it more expensive for individuals and businesses to spend money. The intended effect is to cool down the economy, thereby reducing upward pressure on prices. This mechanism functions on the principle that reduced demand curbs inflation.

Balancing Act

However, the Fed faces a balancing act. Raising interest rates too aggressively to combat inflation can trigger an economic downturn. The challenge lies in finding the optimal level of rate increases that effectively control inflation without significantly harming economic growth and employment.

Consider these points regarding the relationship between rate hikes and inflation:

- Demand Reduction: Higher rates lead to decreased spending, easing pressure on prices.

- Supply Chain Factors: While rate hikes primarily address demand-side inflation, they may not directly resolve supply chain bottlenecks, which can also drive up prices.

- Lag Effect: The full impact of rate hikes on inflation may take several months to materialize, requiring the Fed to anticipate future economic conditions.

Alternative Perspectives

It’s also important to note that there are economists who argue that supply-side factors play a larger role in driving inflation, especially in certain sectors like energy and commodities. These factors are less directly affected by interest rate policies, suggesting that other tools may be necessary for comprehensive inflation control.

- Wage-Price Spiral: If wages continue to rise in response to inflation, it can create a wage-price spiral that is difficult to break.

- Global Factors: Inflation can also be influenced by global economic conditions, making it challenging for the Fed to control inflation solely through domestic monetary policy.

In conclusion, while rate hikes are a key tool for managing inflation, their effectiveness can be influenced by a variety of economic factors. Policymakers must carefully assess the overall economic landscape to ensure that rate hikes are appropriately calibrated to achieve the desired outcome without destabilizing the economy.

Impact on Consumer Spending and Investment

The Federal Reserve’s interest rate decisions directly affect consumer spending and investment, two critical components of economic growth. When interest rates rise, borrowing becomes more expensive, impacting everything from credit card debt to large investment decisions.

Consumer Behavior

For consumers, higher interest rates mean increased costs for borrowing. This could lead to a reduction in spending on discretionary items. Credit card interest rates may rise, making it more expensive to carry a balance. Mortgage rates could increase, cooling down the housing market. The overall effect is that consumers have less disposable income.

Business Decisions

Businesses also face several impacts. Higher interest rates increase the cost of funding new projects and expansions. This can lead to businesses delaying or scaling back investment plans. Consequently, reduced business investment can slow down job creation and economic expansion.

The following are key areas where consumer spending and investment are impacted:

- Credit Card Debt: Higher interest rates on credit cards can make it more difficult for consumers to pay off their balances, leading to increased debt and reduced spending.

- Auto Loans: Increased auto loan rates can affect car sales, as consumers may postpone purchasing new vehicles.

- Housing Market: Higher mortgage rates can decrease demand for housing, potentially leading to a slowdown in the real estate market. Lower demand in housing can cause a crash in the market.

- Business Expansion: Cost of borrowing makes investments less attractive to companies and businesses alike.

In summary, the impact of a Federal Reserve interest rate hike on consumer spending and investment is multifaceted. Higher borrowing costs generally lead to reduced spending and investment, which can have significant implications for economic growth. Consumers and businesses alike need to adjust their financial strategies in response to these changes.

Potential Mitigation Strategies

Given the challenges posed by a Federal Reserve interest rate hike and its impact on the national debt, exploring potential mitigation strategies is crucial. These strategies can involve fiscal policies, debt management practices, and alternative economic approaches.

Fiscal Policy Levers

One approach is to implement fiscal policies that can offset the negative effects of higher interest rates. This could involve targeted government spending to stimulate economic activity or tax reforms to incentivize investment. However, fiscal policy measures must be carefully designed to avoid exacerbating the national debt.

Debt Management Strategies

Effective debt management can play a key role in mitigating the impact of rising interest rates. This includes strategies such as refinancing existing debt at lower rates (if available), extending the maturity of debt to reduce immediate refinancing needs, or diversifying the types of securities issued to attract a wider range of investors.

Innovation and Technology

Investing in innovation and technology can help boost productivity and economic growth, potentially offsetting the drag from higher interest rates. Government support for research and development, infrastructure projects, and education can help foster innovation and enhance long-term economic prospects.

Some specific mitigation strategies include:

- Strategic Debt Refinancing: Seek opportunities to refinance existing debt to take advantage of lower rates where possible.

- Diversification of Debt Instruments: Offer a variety of Treasury securities with different maturities to appeal to diverse investor preferences.

- Fiscal Responsibility: Implement measures to control government spending and increase revenue to reduce the overall debt burden.

In conclusion, mitigating the potential negative impacts of a Federal Reserve interest rate hike requires a multifaceted approach. No single policy or strategy is likely to be sufficient, but a combination of fiscal policy, debt management, and innovation can help navigate the challenges and promote sustainable economic growth.

Long-Term Outlook and Planning

As the Federal Reserve navigates interest rate adjustments and their impacts on the national debt, developing a long-term outlook and planning framework is essential. These factors all contribute to long-term impacts that can ripple effect into the everyday citizen’s life and economy.

Proactive Economic Forecasting

Accurate economic forecasting can help policymakers anticipate the potential effects of interest rate changes. This involves analyzing a wide range of economic indicators, considering global economic conditions, and using sophisticated modeling techniques to project future trends. Proactive forecasting can inform timely and effective policy responses.

Adaptive Debt Management

Adopting an adaptive approach to debt management is crucial. This means being flexible and responsive to changing economic conditions and market dynamics. Rather than relying on a fixed strategy, debt managers should be prepared to adjust their approach as necessary to minimize risks and optimize outcomes.

Contingency Planning

Developing contingency plans can help the government prepare for potential economic shocks or adverse outcomes. This includes identifying triggers that could signal a need for policy adjustments and outlining specific steps that can be taken to mitigate negative impacts. Contingency planning enhances the government’s ability to respond effectively to unforeseen challenges.

Long-term planning should consider:

- Demographic Trends: Account for demographic shifts, such as an aging population, which can impact labor force participation and government expenditures.

- Technological Advancements: Plan for the potential impacts of technological advancements on productivity, employment, and economic growth.

- Global Economic Integration: Recognize the increasing interconnectedness of the global economy and the potential for international events to influence domestic economic conditions.

In summary, a well-defined long-term outlook and planning framework is essential for successfully managing the impacts of Federal Reserve interest rate hikes on the national debt. Proactive economic forecasting, adaptive debt management, and contingency planning are key components of this framework.

| Key Point | Brief Description |

|---|---|

| 📈 Rising Debt Costs | Interest rate hikes boost the cost of servicing the national debt. |

| 💼 Economic Slowdown | Higher rates can curb economic growth by reducing consumer spending and investment. |

| 🛡️ Inflation Control | Rate hikes aim to lower inflation by reducing demand in the economy. |

| 💡 Mitigation | Strategies involve fiscal policies, debt management, and innovation to counter rate hike effects. |

Frequently Asked Questions

▼

The federal funds rate is the target rate that the Federal Reserve wants banks to charge one another for the overnight lending of reserves. It influences other interest rates throughout the economy.

▼

A rate hike increases the cost of issuing new debt, leading to higher interest payments on the national debt as existing securities are refinanced at the new, higher rates.

▼

Yes, rate hikes can help curb inflation by reducing demand in the economy. Higher borrowing costs reduce spending and incentivize saving, reducing upward pressure on prices.

▼

Mitigation strategies include strategic debt refinancing, diversification of debt instruments, and implementing responsible fiscal policies to reduce the overall debt burden.

▼

Higher interest rates translate to increased borrowing costs, impacting revolving and installment debt, cooling demand for big ticket items, potentially reducing disposable income, and influencing investment decisions.

Conclusion

Understanding the intricate interplay between Federal Reserve interest rate hikes and the national debt is crucial for informed decision-making. As the Fed navigates monetary policy, proactive economic forecasting, adaptive debt management, and strategic mitigation measures are essential to ensure sustainable economic growth and stability.