US National Debt Surpasses $35 Trillion: A Deep Dive into Economic Concerns

Anúncios

New Report Shows US National Debt Reaches $35 Trillion: Concerns Over Long-Term Economic Stability, highlighting escalating worries about potential long-term economic repercussions for the United States and its citizens.

A newly released report reveals that the US National Debt Reaches $35 Trillion: Concerns Over Long-Term Economic Stability are now more pressing than ever, sparking widespread discussion and anxiety about the future economic health of the nation.

Anúncios

Understanding the $35 Trillion Milestone

The United States has reached a concerning financial milestone as its national debt has surpassed $35 trillion. This staggering figure represents the accumulation of years of budget deficits, where government spending has exceeded its revenues. Understanding the factors contributing to this debt and its potential consequences is crucial for every American.

What Comprises the National Debt?

The national debt includes both intragovernmental holdings (debt owed by one part of the government to another) and debt held by the public (debt owed to individuals, corporations, and foreign governments). The latter is what typically raises the most concern among economists and policymakers.

Anúncios

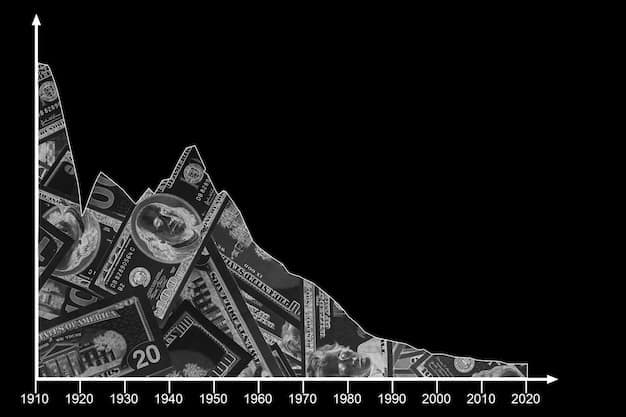

Historical Context of US Debt

The US national debt has been growing steadily for decades, particularly accelerating during economic downturns, wars, and periods of significant government spending. Understanding this historical context helps to contextualize the current $35 trillion figure.

- Economic Recessions: Recessions often lead to increased government spending on social safety nets and stimulus packages, further increasing debt.

- Wars and Conflicts: Military engagements typically require substantial government borrowing.

- Tax Cuts: Significant tax cuts without offsetting spending reductions can also contribute to growing debt.

Reaching $35 trillion underscores the urgency of addressing the nation’s fiscal challenges. Without proper management, this level of debt could lead to serious long-term economic consequences.

Key Factors Contributing to the Rising Debt

Several factors have contributed to the escalating national debt. Identifying these reasons is essential for creating strategies that can effectively manage and reduce the country’s financial burden. Let’s discuss these factors in detail below.

Government Spending Policies

One of the primary drivers of the national debt is government spending. Over the years, spending on various programs, including defense, social security, and healthcare, has significantly increased. Addressing wasteful spending is a key element for tackling the total debt.

Impact of Tax Cuts

Tax cuts, especially when not accompanied by corresponding spending cuts, can significantly impact the national debt. Reduced government revenue can lead to larger budget deficits and increased borrowing. Careful consideration of tax policy implications is necessary for responsible fiscal management.

Economic Downturns and Stimulus Measures

Economic downturns often require governments to implement stimulus measures to support the economy. While these measures can help prevent a deeper recession, they also contribute to the national debt. The balance between short-term relief and long-term fiscal sustainability is tricky, and not all stimulus measures should be seen as equivalent.

- Increased Unemployment Benefits: During recessions, governments often increase unemployment benefits to support those who lost their jobs.

- Infrastructure Spending: Investing in infrastructure projects can create jobs and stimulate economic activity, but also increases debt.

- Direct Payments to Citizens: Stimulus checks can provide immediate relief to households, but add to the overall debt burden.

Understanding the interplay between these factors is critical for developing sound fiscal policies that can curb the growth of the national debt.

The Economic Implications of a $35 Trillion Debt

A national debt of $35 trillion carries substantial economic implications that can affect various aspects of American life. Let’s consider several key areas where this debt can have a significant impact on both the American economy and its citizens.

Impact on Future Generations

One of the most concerning implications is the burden placed on future generations. A large national debt means that future taxpayers will have to pay more in taxes to service the debt, which could stifle economic growth and reduce living standards. Ignoring this challenge is immoral.

Effects on Interest Rates

A high national debt can lead to higher interest rates. As the government borrows more money, it can drive interest rates upward, making it more expensive for businesses and individuals to borrow, invest, and consume. This can slow down economic activity.

Risk of Inflation

Excessive government borrowing can lead to inflation if the money supply increases faster than the economy’s ability to produce goods and services. Inflation erodes purchasing power and can destabilize the economy, so governments should carefully manage inflation rates.

- Increased Cost of Goods: Inflation causes the prices of goods and services to rise, reducing the purchasing power of consumers.

- Decreased Investment: High inflation can discourage businesses from investing, as it creates uncertainty about future returns.

- Reduced Savings: Inflation erodes the value of savings, making it harder for individuals to achieve their financial goals.

The potential economic implications of a $35 trillion national debt underscore the importance of responsible fiscal management. Addressing this issue requires careful planning and strategic policy decisions.

Potential Solutions and Policy Recommendations

Addressing the challenge of the $35 trillion national debt requires a multifaceted approach involving both spending cuts and revenue increases. Several policy recommendations could help stabilize and reduce the debt over time. It’s important that these are carefully considered using all available information.

Spending Reforms

One approach is to implement spending reforms. These reforms could involve cutting wasteful spending, improving the efficiency of government programs, and re-evaluating budget priorities. Improving the return on investment of governmental initiatives is also a good idea.

Tax Policy Adjustments

Adjusting tax policies is another potential solution. This could include raising taxes on higher earners, closing tax loopholes, and implementing a more progressive tax system. It’s also important to consider various impacts of new tax policies.

Entitlement Program Reforms

Reforming entitlement programs such as Social Security and Medicare is another area for consideration. These programs face long-term funding challenges, and reforms could help ensure their sustainability. This includes adjusting eligibility requirements and benefit levels.

- Raising the Retirement Age: Gradually increasing the retirement age can help reduce the long-term costs of Social Security.

- Adjusting Benefit Formulas: Modifying the formulas used to calculate benefits can also help reduce costs.

- Means Testing: Implementing means testing to determine eligibility for certain benefits can target resources to those most in need.

By implementing a combination of these policy recommendations, the United States can work towards stabilizing and reducing its national debt, ensuring a more secure economic future.

Global Perspectives on National Debt

The United States is not alone in facing the challenge of high national debt. Many countries around the world grapple with similar issues, and examining their experiences can provide valuable insights and lessons. Comparing different approaches and their outcomes can inform policy decisions and strategies for debt management.

Debt Levels in Other Developed Nations

Several developed nations have high debt levels relative to their GDP. Japan, Italy, and Greece are examples of countries with significant public debt. Comparing their strategies for managing debt can provide useful insights.

Strategies Employed by Other Countries

Various countries have adopted different strategies to manage their national debt. Some have focused on austerity measures, while others have prioritized economic growth. The success of these strategies depends on each country’s unique circumstances.

Lessons Learned from International Experiences

International experiences highlight the importance of fiscal discipline, sustainable economic policies, and structural reforms. Countries that have successfully managed their debt have often implemented comprehensive strategies tailored to their specific needs.

- Fiscal Consolidation: Implementing measures to reduce government spending and increase revenue.

- Structural Reforms: Addressing underlying economic issues that contribute to debt accumulation.

- Prudent Monetary Policy: Maintaining stable prices and supporting economic growth through monetary policy.

By learning from the experiences of other nations, the United States can develop more effective strategies for managing its national debt and ensuring long-term economic stability.

The Role of Citizens in Addressing the Debt

Addressing the $35 trillion national debt is not solely the responsibility of policymakers; it also requires the active engagement and understanding of citizens. Informed citizens can advocate for responsible fiscal policies and hold their elected officials accountable. Citizens must understand these challenges to protect their own self intersts.

Understanding Fiscal Policy

Informed citizens should have a basic understanding of fiscal policy and its impact on the national debt. This includes understanding government spending, taxation, and the budget process. Citizens should advocate for sustainable economic policies.

Engaging with Elected Officials

Citizens can play a crucial role by engaging with their elected officials and expressing their concerns about the national debt. This can include writing letters, attending town hall meetings, and participating in public forums. This is necessary because many politicians prioritize what is strategically adventageous rather than what is best for the populace.

Promoting Responsible Spending and Saving

Individuals can contribute to the solution by practicing responsible spending and saving habits. This can help reduce the demand for government services and promote a more stable economy, so start by doing your part today.

- Reducing Personal Debt: Minimizing personal debt can help reduce the overall demand for credit and promote financial stability.

- Saving for Retirement: Saving adequately for retirement can reduce the burden on social security and other government programs.

- Supporting Local Businesses: Supporting local businesses can help stimulate economic growth and create jobs.

By becoming informed and engaged citizens, individuals can contribute to a more sustainable and prosperous economic future for the United States.

| Key Point | Brief Description |

|---|---|

| 💰 Rising Debt | US national debt hits $35 trillion, raising economic stability concerns. |

| 📈 Economic Impact | Future generations face higher taxes; interest rates may increase. |

| 💡 Solutions | Spending reforms, tax adjustments, and entitlement program changes. |

| 🌍 Global View | International experiences provide insights for debt management strategies. |

Frequently Asked Questions

▼

The US national debt is the total amount of money the US federal government owes to its creditors. This includes debt held by the public and intragovernmental holdings.

▼

Key factors include government spending policies, tax cuts, and economic downturns. Increased spending and tax cuts without corresponding revenue increases lead to higher debt.

▼

A large national debt places a burden on future taxpayers, who will have to pay more in taxes to service the debt. This can stifle economic growth and reduce living standards.

▼

Potential solutions include spending reforms, tax policy adjustments, and entitlement program reforms. These measures aim to reduce government spending and increase revenue sustainably.

▼

Citizens can become informed about fiscal policy, engage with elected officials, and promote responsible spending and saving habits. This helps advocate for sound fiscal policies.

Conclusion

The US National Debt Reaches $35 Trillion: Concerns Over Long-Term Economic Stability, it’s a stark reminder of the fiscal challenges facing the United States. Addressing this issue requires a comprehensive approach involving policy changes, citizen engagement, and a commitment to responsible financial management to ensure a more secure and prosperous future for all by learning from current events.